Complaint Pay and Wage Statements

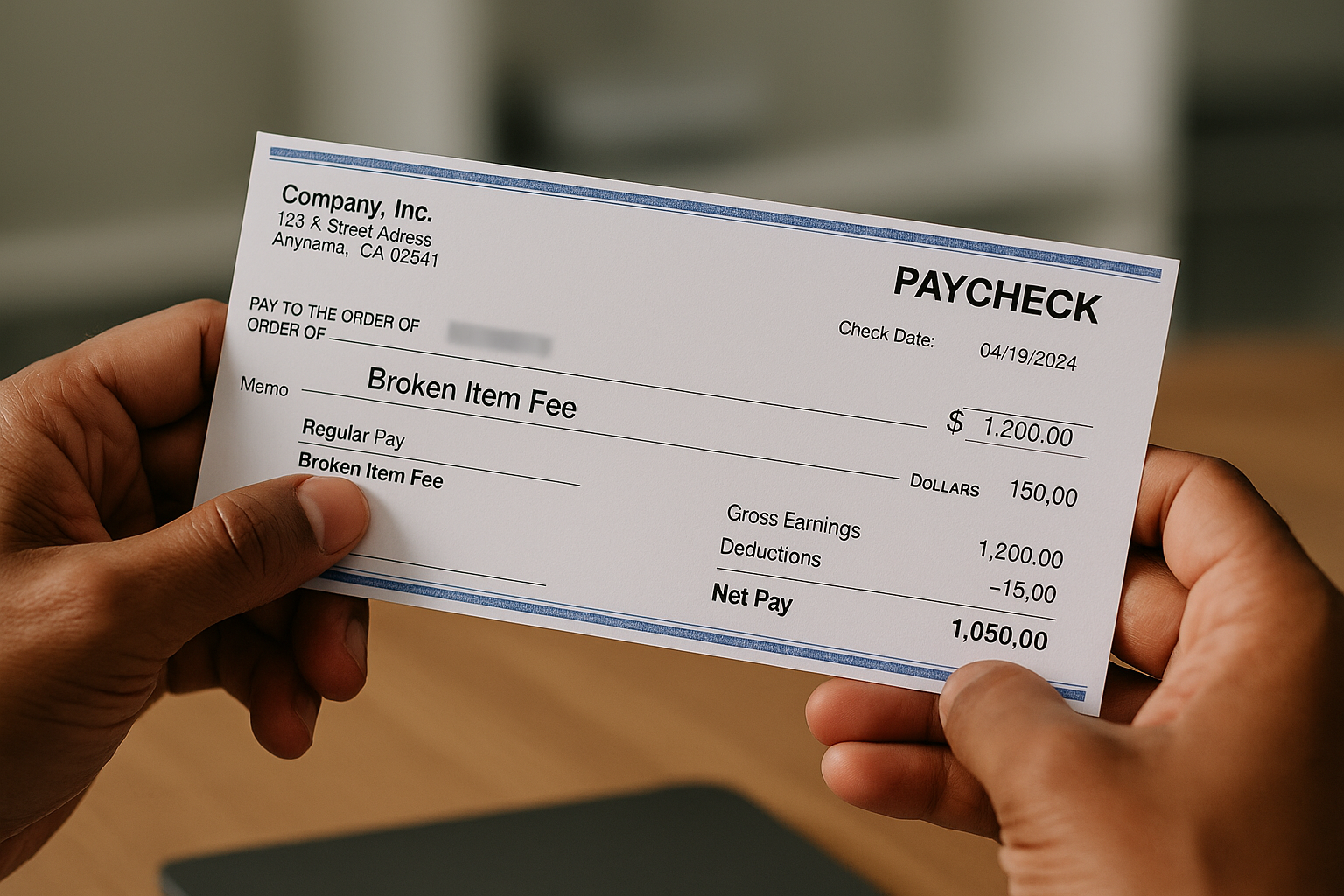

California law requires that every employee receive an accurate, itemized wage statement with each paycheck. Under Labor Code § 226, employers must provide a wage statement that clearly shows how pay was calculated — so employees can confirm that they have been paid correctly. When employers issue inaccurate or incomplete paystubs, or otherwise misstate hours, rates, or deductions, they violate California law and may owe significant penalties.

A compliant wage statement must include at least nine specific pieces of information:

Gross wages earned;

Total hours worked (for non-exempt employees);

The number of piece-rate units earned, if applicable;

All deductions;

Net wages earned;

The inclusive dates of the pay period;

The employee’s name and only the last four digits of the Social Security number or employee ID;

The employer’s legal name and address; and

All applicable hourly rates and hours worked at each rate.

Even small errors — such as failing to list total hours, the correct employer name, or the pay period dates — can create confusion and hide wage theft. Wage statement violations often accompany other forms of misconduct, such as unpaid overtime, missed meal and rest break premiums, or improper deductions.

Employees have the right to inspect or copy their pay records upon request, and employers must produce them within 21 calendar days under Labor Code § 226(c). When they fail to do so, or when paystubs contain inaccuracies that cause injury — such as confusion or difficulty determining owed wages — employees can recover statutory penalties of up to $4,000 per employee, along with costs and attorney’s fees.

Common paycheck violations also include:

Paying the wrong hourly rate or failing to include bonuses or commissions in overtime calculations;

Issuing “off-the-books” cash payments;

Failing to provide final paychecks on time after termination; or

Misstating premium pay for missed meal or rest breaks.

At Levine Labor Law, we review paystubs and payroll records line by line to uncover wage statement errors, recover unpaid wages, and seek statutory penalties under Labor Code § 226 and related provisions. When employers cut corners, we make sure workers get every cent — and every record — they’re legally owed.